SoftBank’s reduced Arm price tag is still too high

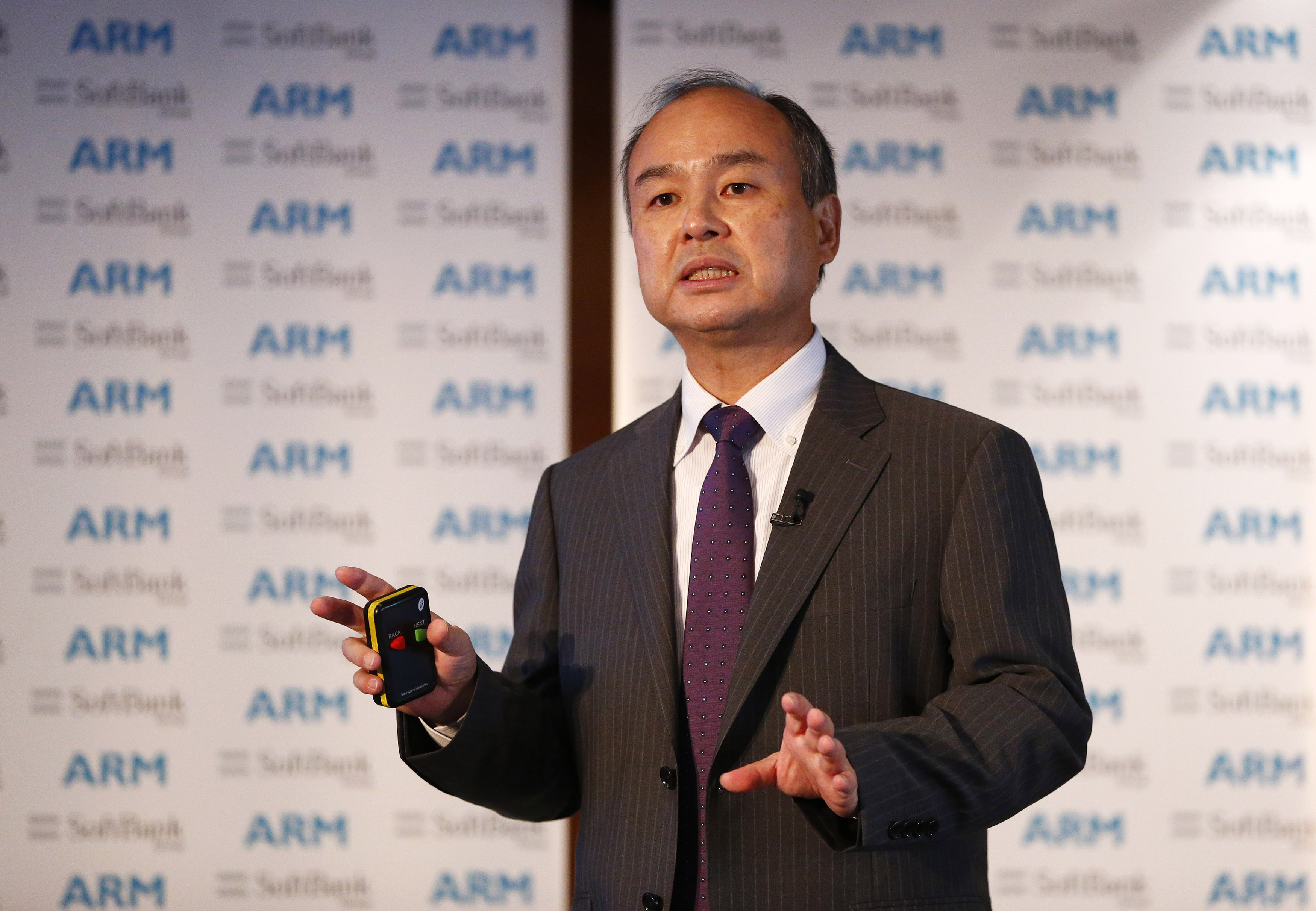

CEO of the SoftBank Group Masayoshi Son speaks at a new conference in London, Britain July 18, 2016. REUTERS/Neil Hall - LR1EC7I0U5JKD Acquire Licensing Rights

LONDON, Sept 5 (Reuters Breakingviews) - The semiconductor industry has changed immeasurably since Japanese conglomerate SoftBank Group (9984.T) bought Arm for $32 billion in 2016. Yet the British chip designer’s fair value may be in that same ballpark, according to a Breakingviews valuation.

SoftBank said on Tuesday it was seeking an equity value of $50 billion to $54 billion as part of the roadshow for Arm’s initial public offering, factoring in shares issued to employees that are yet to vest. When the Japanese conglomerate’s boss Masayoshi Son scooped up the Cambridge-based company seven years ago, he was placing a bet on the so-called Internet of Things, the view that tiny semiconductors would proliferate across everyday household items and provide the next leg of growth for chip designers. Now he’s pitching it instead as a central player in artificial intelligence, the new industry vogue.

Stock-market AI darling Nvidia (NVDA.O) at first glance seems to validate Son’s valuation hopes. The Californian chip designer’s enterprise value has recently soared to $1.2 trillion, or 23 times analysts’ average forecasts for its revenue this year, LSEG data shows. On that basis, Arm’s top line could stagnate at $2.7 billion and still justify a greater than $60 billion equity value, after including its $2 billion of net cash.

But that misunderstands Nvidia’s ascent, which is underpinned by massive increases in forecasts for operating profit. The mean analyst prediction for earnings before interest and taxation in the financial year to January 2026 has more than doubled since the start of May. The lesson for SoftBank and Arm is clear: chip investors are laser-focused on medium-term operating profit, not just revenue.

There are three key moving parts to Arm’s valuation. First is its top-line growth, which has been lumpy, dropping 1% in the last fiscal year but leaping 33% in the preceding 12 months. SoftBank in a recent earnings presentation highlighted a longer-term trend: Arm’s 14% compound annual growth rate over the past three years, using fiscal first-quarter figures. Apply that pace of expansion to the most recent calendar year, which makes it easier to compare Arm to listed peers, and the company’s revenue would reach $4 billion in 2025.

Second is the operating margin, or the percentage of sales that’s left over after deducting all costs other than interest and taxes. Under SoftBank, Arm’s operating margin has dropped to around 25%, from roughly 40% in 2015 – a consequence of Son’s preference for heavy investments in research. Bernstein analysts reckon a publicly listed Arm might nudge the margin back up to 33% within three years, if it lets costs grow slightly slower than revenue. On that basis, the company would pump out $1.3 billion of operating profit in 2025.

Third is the valuation multiple, which is best judged by looking at what investors are prepared to pay for similar listed companies. Nvidia, Cadence Design Systems (CDNS.O) and Synopsys (SNPS.O) are good choices. The first is exposed to Son’s beloved AI trend, while the latter two U.S. firms make software for chip designers, much like Arm, which licenses intellectual property for processors. On average, the trio have a current enterprise value of 25 times the operating profit analysts reckon they’ll earn in 2025, using LSEG data.

If Arm nabbed the same multiple, its enterprise value would be $33 billion, using the above growth and operating margin. Add the SoftBank-owned company’s net cash as of June 30, and the market capitalisation would be $35 billion.

Son last month agreed to pay a significantly higher valuation of $64 billion when SoftBank bought 25% of Arm from the Saudi Arabia-backed Vision Fund. In that context, the new $50 billion to $54 billion target would already represent an embarrassing step down. But even to justify the lower valuation, investors would have to torture the assumptions.

Start with revenue. AI star Nvidia’s top line will grow at a compound annual rate of 51% from 2022 to 2025, according to average analyst forecasts gathered by LSEG. Assume that Arm captures some of the same gold dust and grows at a 20% annual clip up to 2025. Holding other assumptions constant, Arm’s fair value would rise to $41 billion. It’s hard to see a case for raising the valuation multiple beyond 25 times, which is already much higher than the average 22 times multiple that Arm managed in its final three years as a public company before SoftBank swooped. So profitability has to do the final lift. To clear a $50 billion equity value the 2025 operating margin would have to surpass pre-SoftBank levels of around 40%, while revenue grows at 20% a year.

That’s an implausible scenario. To mimic and sustain Nvidia-esque growth, Arm CEO Rene Haas would have to keep ramping up investments in engineers and sales teams, which would weigh on margins. On the other hand, boosting profitability by reining back spending would probably make a turbocharged top line impossible. Arm can either have a rapidly rising top line or rapidly rising margins, but probably not both.

The company itself acknowledged this tradeoff in a 2021 filing making the case for its sale to Nvidia, which was blocked by antitrust authorities. “The capital markets would expect Arm to make significant strategic changes, including cutting costs…” the parties said, referring to the possibility of an IPO, concluding that the UK group faced “significant challenges to growth” as a standalone company. SoftBank’s hoped-for price range only works if investors are willing to believe two mutually contradictory things at once. That may be possible for a short while, especially if the stock market’s AI hype persists, but it’s hardly the basis for a stable valuation over time.

Follow @liamwardproud on X

(The author is a Reuters Breakingviews columnist. The opinions expressed are his own.)

CONTEXT NEWS

SoftBank Group is seeking a valuation of between $47 and $51 per share in Arm’s initial public offering, according to a regulatory filing on Sept. 5.

Factoring in share awards yet to vest, the price range translates into a valuation for the UK-based chip designer of between $50 billion and $54 billion.

Customers of Arm including Apple, Nvidia, Alphabet and Advanced Micro Devices have agreed to invest in the chip designer’s initial public offering at a valuation between $50 billion and $55 billion, Reuters reported on Sept. 1 citing people familiar with the matter.

SoftBank agreed in August to acquire the 25% of Arm that it did not already own from its Vision Fund investment vehicle at a valuation of $64 billion.

Arm plans to price its shares on Sept. 13, with trading scheduled to begin on the Nasdaq exchange the following day, according to Reuters.

Editing by George Hay, Katrina Hamlin and Oliver Taslic

Our Standards: The Thomson Reuters Trust Principles.