As U.S. securities regulator FINRA faces constitutional challenge, Bill Barr calls for defanging it

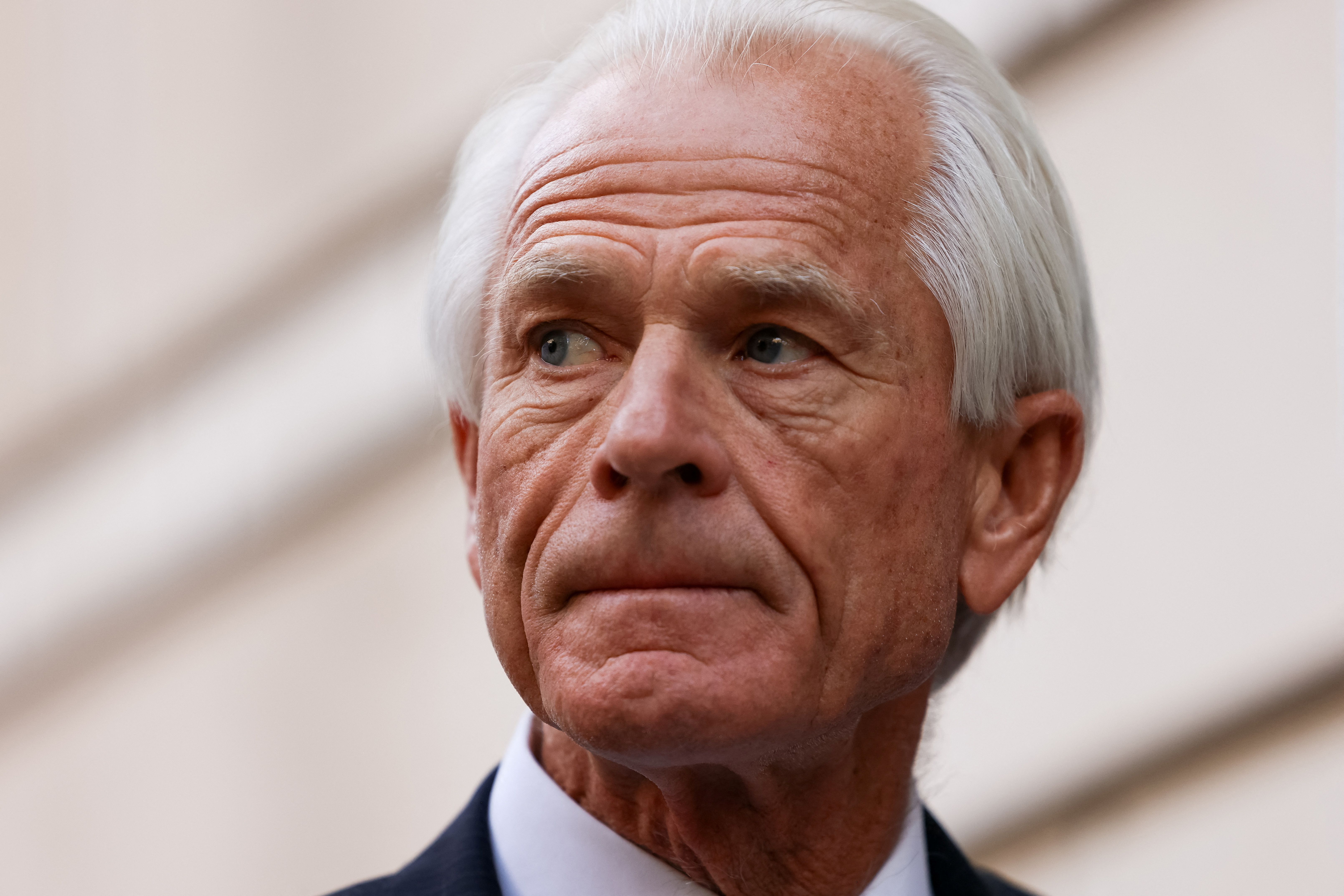

U.S. Attorney General William Barr participates in a roundtable discussion about human trafficking at the U.S. Attorney's Office in Atlanta, Georgia, U.S., September 21, 2020. REUTERS/Elijah Nouvelage Acquire Licensing Rights

Sept 7 (Reuters) - The private company that oversees the securities industry, best known by its acronym FINRA, is facing what could be an existential threat in a federal appeals court in Washington, D.C., where judges have already signaled “serious” constitutional concerns about whether FINRA can exercise enforcement power.

Donald Trump’s former Attorney General William Barr and former U.S. Solicitor General Noel Francisco want to hasten FINRA’s defanging.

The two Justice Department alums pitched arguments in a friend-of-the-court brief filed on Wednesday, putting them at odds with the Biden Justice Department, which backs FINRA. Current Justice Department lawyers told the District of Columbia U.S. Court of Appeals in June that FINRA’s structure as a private, self-regulatory organization is “entirely consistent with the constitution.”

This clash between the Justice Department and two onetime DOJ honchos underscores the potential consequences of the FINRA appeal at the D.C. Circuit.

The case began as an attempt by broker-dealer Alpine Securities Corp to shut down an expedited FINRA hearing to expel Alpine from the organization and obtain restitution for customers allegedly overcharged millions of dollars in fees. (Alpine counsel Brian Barnes of Cooper & Kirk did not respond to my email.)

Alpine filed a suit to enjoin the FINRA hearing, arguing two alternative theories for why FINRA is unconstitutionally structured. (The broker also advanced additional constitutional arguments, including Due Process and First Amendment defenses, but those are not at issue before the D.C. Circuit, so I'm skipping them.)

First, Alpine said, FINRA hearing officers wield tremendous power to enforce federal securities laws – the domain of the executive branch – so they are, in effect, government actors. Yet, as purportedly private employees, they are not accountable to the president. That framework, according to Alpine, violates the Appointments Clause, because the president has no role in picking FINRA officers, and other provisions in Article II of the constitution, because FINRA officers are shielded from removal by the president.

Alternatively, Alpine argued, if FINRA is not a government actor, then its enforcement of federal securities laws runs afoul of the constitutional nondelegation doctrine, which holds that federal power can only be wielded by the federal government. Private entities can play a role, as Alpine acknowledges, in enforcing federal law. But in those limited situations, federal agencies must closely oversee the private groups. Alpine contends that the SEC’s oversight of FINRA is too attenuated to pass constitutional muster.

U.S. District Judge Beryl Howell rejected all of Alpine’s arguments in June. Howell concluded that FINRA is not a state actor, pointing to a long line of precedent holding that the group is a private self-regulatory organization. And nondelegation doctrine doesn’t apply, Howell said, because the SEC has ultimate control and oversight over FINRA, including the power to reject FINRA enforcement decisions.

Alpine then turned to the D.C. Circuit, asking the appeals court for an emergency injunction to halt FINRA's expedited proceeding.

Both FINRA, represented by Gibson, Dunn & Crutcher, and the Justice Department urged the circuit court judges to deny the injunction. The Justice Department, which intervened in the case to defend FINRA, argued in particular that Alpine’s arguments are contradicted by the SEC’s oversight of FINRA.

“FINRA is a private, self-regulatory organization whose front-line supervision of its own members is subject to plenary SEC oversight and review,” the Justice Department said. “It is thus not a state actor.”

A divided three-judge D.C. Circuit panel nonetheless granted Alpine’s motion in July – and that’s where things get spicy. In a concurring opinion, Judge Justin Walker, a 2020 appointee to the appeals court, said that FINRA hearing officers seem to act with the same authority as SEC administrative law judges -- and those judges, under recent U.S. Supreme Court precedent, are subject to the Appointments Clause.

"That may be a constitutional problem," Walker wrote. “There is a serious argument that FINRA hearing officers exercise significant executive power. And it is undisputed that they do not act under the President."

FINRA pleaded with the entire D.C. Circuit to reconsider the panel decision, warning that the injunction “threatens to upend" FINRA enforcement. Over several decades, FINRA said, appellate courts in other circuits have consistently rebuffed challenges to FINRA’s role, recognizing that the private group is not a state actor but a congressionally authorized private self-regulator operating under the ultimate control of the SEC.

If the D.C. Circuit were ultimately to side with Alpine, it would “decapitate FINRA’s enforcement program,” FINRA said, and “thereby destroy the self-regulatory model that has served the securities industry and investors so well.”

The appeals court denied FINRA’s motion last month, clearing the way for Alpine to file its opening brief on the merits last week.

That filing, in turn, prompted two briefs filed on Wednesday in support of Alpine, one from the New Civil Liberties Alliance, a nonprofit that frequently represents defendants targeted in SEC proceedings; and the other from Barr, now at Torridon Law, and Francisco, a partner at Jones Day. Their brief is on behalf of the American Free Enterprise Chamber of Commerce, a recently formed group dedicated to the proposition that the “insatiable expansion of the federal regulatory state” is strangling American businesses.

The brief from Barr and Francisco offers essentially the same arguments as Alpine: FINRA hearing officers are state actors who are unconstitutionally appointed and unconstitutionally insulated from removal; and, alternatively, FINRA is unconstitutionally exercising executive-branch power without sufficient government oversight.

“FINRA seeks to carve out for itself what is effectively a Constitution-free twilight zone—private enough to avoid the constitution’s structural appointment-and-removal safeguards, but public enough to ... avoid any non-delegation concerns, all while maintaining a degree of operational independence that prevents any meaningful supervision or control,” the onetime DOJ honchos argued. “The Constitution cannot tolerate such an arrangement.”

Barr and Francisco did not respond to a request for comment. The Justice Department also did not respond. A FINRA spokesperson sent an email statement: “FINRA looks forward to the D.C. Circuit’s consideration of [Alpine’s] appeal, when FINRA and the U.S. government will present their defenses to [Alpine’s] novel and unsupported constitutional arguments.”

Reporting By Alison Frankel; editing by Leigh Jones

Our Standards: The Thomson Reuters Trust Principles.